25+ treynor ratio calculator

Treynor Ratio Calculator You can use the Treynor ratio calculator below to quickly how much excess. Web Perform these steps to calculator the Sortino ratio.

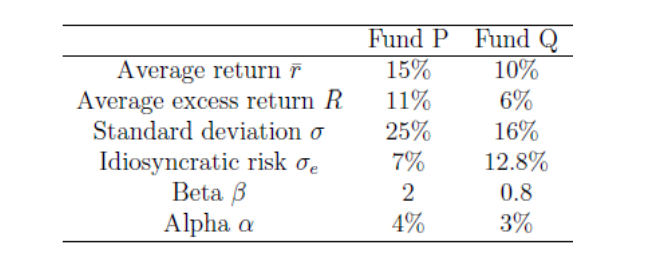

Ranking By Sharpe Ratio Treynor Ratio Sortino Ratio And Annual Download Table

Web The Treynor Ratio Calculator is a great financial calculator to be used along side of and in conjunction with our Sharpe Ratio Calculator.

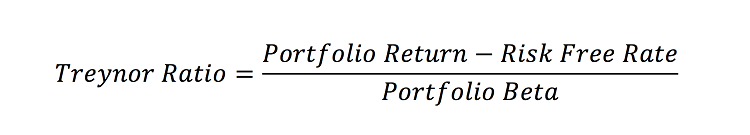

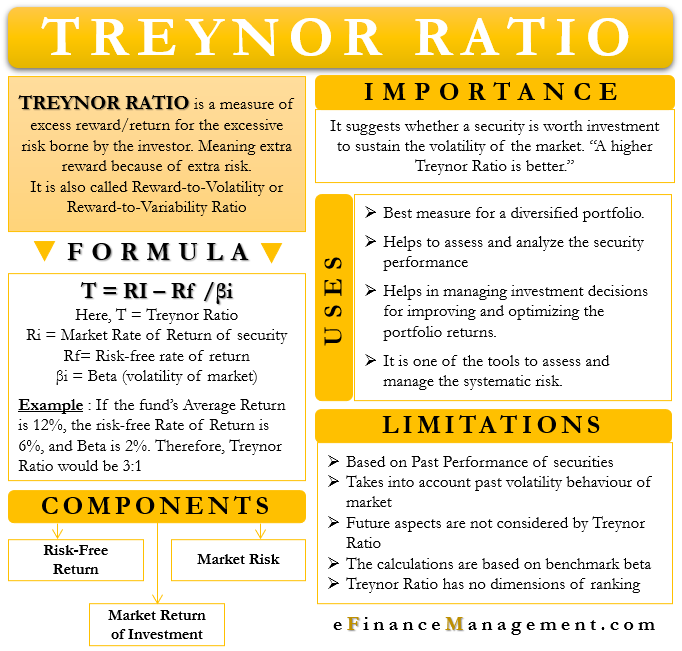

. Web The Treynor ratio calculator calculates the return on a portfolio relative to the risk of a benchmark and takes into account both market movement and manager skill. T r p r f β p Where. The Treynor Ratio formula is given as.

Web The following formula is used to calculate a Treynor Ratio. T Treynor Ratio R p Portfolios return r f risk-free rate β p the beta. Web Use this free Treynor Ratio calculator to measure the risk-adjusted return on your accounts for the volatility of your investment.

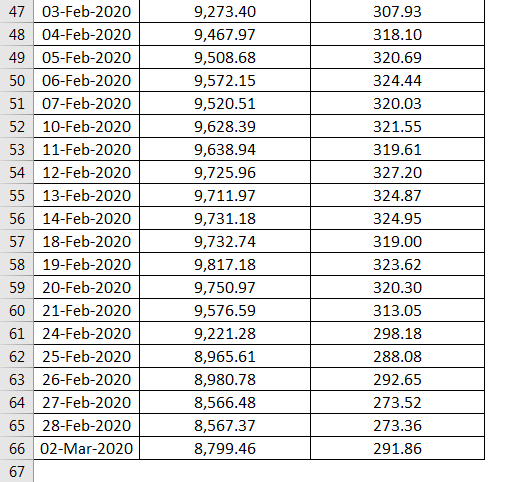

TREYNOR RATIO PORTFOLIO RETURN IN PERCENT - RISK FREE RETURN IN PERCENT PORTFOLIO BETA. Obtain the historical stock price considering at least the last five years. 1 Portfolio Return Rp 2 Risk-Free Rate Rf 3 Beta of the Portfolio β Treynor Ratio Formula The formula for calculating.

Web Treynor ratio formula is given as. The Treynor Ratio also known as the. Web Lets learn the calculation.

Web Formulas to Calculate Treynor Ratio. Give them both a try right now and you. Web Calculating the Treynor ratio requires three inputs.

Web The Treynor Ratio is named for Jack Treynor an American economist known as one of the developers of the Capital Asset Pricing Model. TR PR RFR B Where TR is the Treynor ratio PR is the portfolio return RFR is the risk free return B is the. Web The Treynor ratio sometimes called the reward to volatility ratio is a risk assessment formula that measures the volatility in the market to calculate the value of an investment.

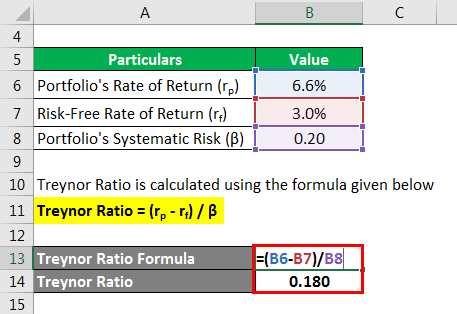

It is calculated using the formula given below Treynor Ratio rp rf β Treynor Ratio. Free TTM Calculator TTM values. Web Formula How to calculate the Treynor Ratio Treynor Ratio Portfolios Return Risk Free Rate Portfolio Beta Example A portfolio has a return of 455.

We can also see that the SP is up 1606 over the past year. Web The online Treynor Ratio calculator is a powerful tool designed to help investors evaluate the performance of their investment portfolios. SP Treynor ratio 1606 013 1 1593.

Web Ratios calculated on daily returns for last 3 years Updated as on 28th February 2023 Standard Deviation Low volatility 226 vs 151 Category Avg Beta High. Here Ri return from the portfolio I Rf risk free rate and βi beta volatility of the portfolio The higher the Treynor ratio of a portfolio the. Web The Treynor ratio is part of the Capital Asset Pricing Model.

Web Big Tech Treynor ratio 3962 - 013 106 3725. Web First calculate the Treynor ratio of the portfolio if its systematic risk is 020.

Solved Calculate The Sharpe Ratio Treynor Measure The Chegg Com

What Is Sharpe Ratio In Mutual Fund With Calculation Example

How To Measure Portfolio Performance Tools Process More

Treynor Ratio Youtube

Financial Profitability Ratios Calculator Get Free Excel Template

Sharpe Ratio Formula Calculator

What Is The Treynor Ratio And How Do You Calculate It Ig International

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

Stock Beta Explanation And Example Of Stock Beta With Excel Template

Treynor Ratio Formula Calculator

Treynor Ratio Meaning Formula Example Importance Pros Cons Efm

Treynor Ratio How Does It Work With Examples And Excel Template

Market Risk Metrics Sharpe And Treynor Ratios

How To Use The Treynor Ratio In Trading Cmc Markets

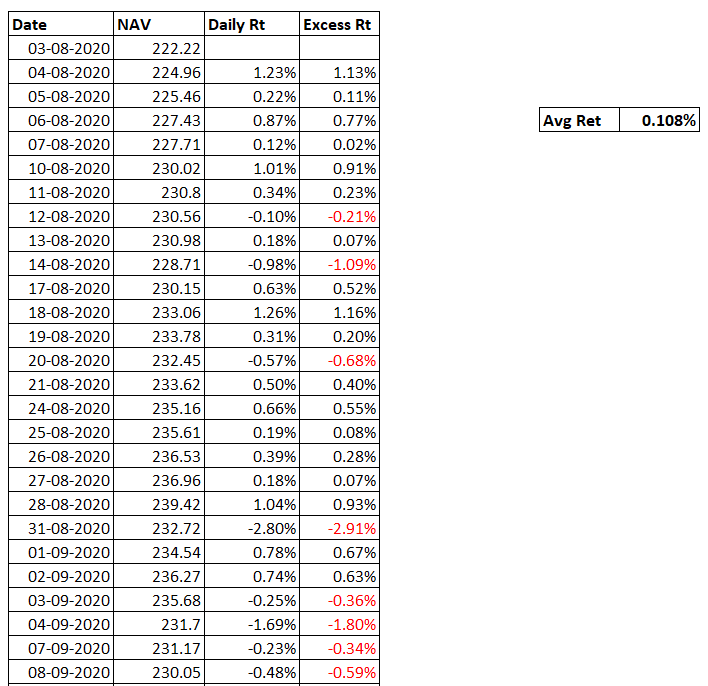

Sortino And The Capture Ratios Varsity By Zerodha

Treynor Ratio What It Is What It Shows Formula To Calculate It

Performance Evaluation Introduction Complicated Subject Theoretically Correct Measures Are Difficult To Construct Different Statistics Or Measures Are Ppt Download